One bitcoin will be worth well over 1 million dollars by 2030 – predicts Jeff Ross from Vailshire Capital Management

Bitcoin provides a safe savings alternative to hedge against the rapid monetary inflation promoted by central banks around the world – argues Jeffrey W. Ross, founder and managing director of Vailshire Capital Management.

Piotr Rosik (Investors Zone): Why do You buy Grayscale Bitcoin Trust (GBTC) units and promote such a solution? Isn't it better to buy BTC at the cryptos exchanges and take it out of there?

Jeffrey W. Ross (founder and managing director of Vailshire Capital Management): My personal preference is to buy bitcoin at exchanges, then transfer the BTC into a wallet. However, for my hedge fund Vailshire Partners LP and Vailshire separately managed account clients, I often buy GBTC. GBTC is very easy to buy and sell within brokerage accounts. As an added bonus, it has recently been trading at a discount to net asset value, which I believe to be a low-risk and profitable arbitrage idea.

How will bitcoin behave in conditions of high inflation? Can such a macro environment accelerate its price growth?

Other than occasional cyclical pullbacks, I think that bitcoin will perform well in most market conditions because of it’s programmed supply disinflation and growing base of users. Inflation and, possibly, hyperinflation are legitimate concerns over the coming decade. Bitcoin provides a safe savings alternative to hedge against the rapid monetary inflation promoted by central banks around the world.

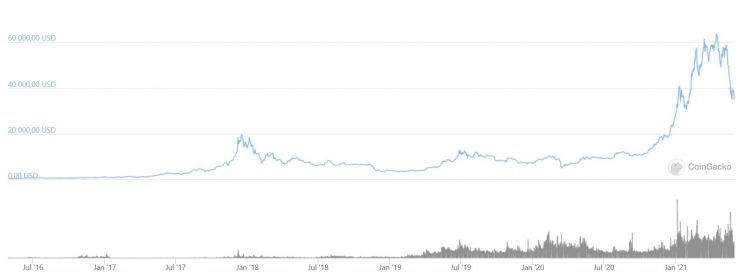

BTC/USD – 5 years

Source: CoinGecko

Recently, Tesla withdrew from accepting BTC in the settlement of cars. Why has this happened? And why did bitcoin react so violently to this news?

Elon Musk is actually pro-bitcoin and, I believe, is just trolling the public with his seeming anti-bitcoin tweets. I have no inside information, but I believe that he is knowingly promoting a false narrative about bitcoin’s “wasteful” energy consumption, so he can later promote an integrated “solution” involving Tesla’s solar production, power walls, and bitcoin mining. The market participants sold their bitcoin because very few truly understand what it is and how it actually improves energy efficiency over time—driving down costs and improving quality of life for people around the world. The increasingly secure Bitcoin network doesn’t waste energy, it consumes energy waste.

Do You think that in the future the price of bitcoin will continue to move in the cycles we know: two years of bull market, two years of a bear market?

It is hard to draw conclusions about the future price action of bitcoin, given that it has only existed for approximately 12 years. The comparative sample size is small! That said, I think that we will continue to see boom and bust cycles while bitcoin remains relatively small as an investable asset class, currently under $1T. Once the “market cap” of bitcoin grows to $50T-100T, the volatility and major market swings and cycles should diminish.

What do You think about the S2F model created by Plan B - will this model work in the long term? Maybe you know better predictive models for the BTC price?

I think Plan B’s contributions to the bitcoin space have been very constructive. The stock to flow and stock to flow cross asset models have provided a meaningful framework to the valuation of bitcoin based on a disinflationary supply of bitcoin entering the market until year 2140, when nearly 21 million bitcoins will have been mined. Since bitcoin is the only perfectly scarce asset, the models imply the value of bitcoin will approach infinity over time. Since “infinity” is mathematically impossible, the models must break down at some point. But when will this actually occur? I don’t know.

The models also don’t factor in demand for bitcoin in any way, which I find interesting. Demand, network growth, and Metcalfe’s Law all play important roles in the adoption and value of Bitcoin over time but are completely excluded from the S2F models.

Bitcoin Stock / Flow Model (S2F)

Source: Plan B

Are there any cryptocurrencies on the horizon that could threaten bitcoin's position? I know that Your fund also buys ethereum - does this cryptocurrency have any advantages over bitcoin?

No. Bitcoin is not in competition with other cryptocurrencies. It has already perfectly solved the world’s store of value problem, which has befuddled rulers, ruined nations, and harmed citizens around the world for millennia. Currency devaluation destroys cultures over time… every time. Other cryptocurrencies may be solving other, unrelated problems, or may be providing entertainment or speculative value, but are unrelated to the mission and purpose of Bitcoin.

Ethereum, in my opinion, is a hot mess. It is trying to be all things to all people and will have many victories and defeats along the way. It should continue to grow over time and do well on occasion as a speculation… but I am not convinced it will still exist in 10 to 20 years. Time will tell.

What do you think about the concept of central banks digital currencies (CBDC) and can they somehow threaten the position of cryptocurrencies and bitcoin, or on the contrary - will they strengthen it?

Central bank digital currencies are simply a more intrusive version of current fiat currencies. They will be programmable and fully trackable. Similar to current government fiat, the value of CBDC’s will trend to zero over time, which is the exact opposite of bitcoin. Their introduction will further strengthen the bitcoin network as people get increasingly comfortable with the concept of digital currencies and spend time studying the difference between them and bitcoin. The former erodes purchasing power and freedom, while the latter appreciates in value and provides a degree of self-sovereignty.

Is it possible that one day central banks or governments will be able to ban BTC?

Many will try, but none will be successful. Banning Bitcoin is just as “easy” as banning the internet, which is to say it is no longer possible. The only long-term viable solution for central banks and governments--no matter how powerful--is to accept and embrace Bitcoin as a digital reserve asset. I believe that most central banks will own at least some bitcoin as a reserve asset by 2030. If not, they may cease to exist in the coming decades.

There are many "black scenarios" for BTC, such as 51% attack, breaking the hash algorithm, drastic decrease in the number of nodes. Which of them seems most likely to You?

None of these are likely. The cost of doing so is prohibitive and the effects can be quickly negated by the bitcoin developers. Bitcoin is not static; it has some of the world’s greatest minds financially incentivized to ensure its growth and safety. In the event that any such “black scenario” occurs, the network can be quickly and safely hard forked… and the value of the network preserved.

The value of the BTC market is currently 1/10 of the value of the gold market. Will BTC ever win the rivalry with gold and outperform in terms of market value?

Yes. I believe that Bitcoin’s “market cap” will surpass gold’s market cap by 2025 or 2026, then will move far beyond it’s valuation. I think that $100T is a very reasonable and attainable valuation for Bitcoin by 2030.

What do You think about comparing bitcoin to gold, anyway? Recently, there was a debate under this slogan, with the participation of Michael Saylor and Frank Giustra. Can bitcoin make no one want gold anymore, or maybe people will always want something tangible in a home safe?

The narrative of Bitcoin necessarily changes at it grows in order to provide context for current and prospective buyers. Since gold’s $10T-11T market cap is the next major milestone for bitcoin, people are fixated on the concept of bitcoin being “gold 2.0.” Once this market cap is attained and surpassed, the public narrative will change and will likely focus on the market cap of individual currencies, bonds and, eventually, real estate.

The desire to own physical gold is still powerful among certain Baby Boomers and a handful of some Gen X-ers. Younger generations (Millennials, Gen Z, etc.) don’t understand this fascination and are much more trusting of valuable, immutable code as a long-term store of value.

Many investors are looking forward to US BTC ETF, and meanwhile, there are already several cryptocurrency funds of this type in Canada. Why is Canada overtaking the US?

The SEC is being very slow in approving a bitcoin ETF. Their concerns have been warranted to date, as exchange activity is notoriously difficult to predict and measure, much less regulate. As more and larger institutions enter the space, Bitcoin’s infrastructure will be built-out and become increasingly secure, which will lead to a surge higher in price as new - traditionally more conservative and wealthy - market participants enter the space. I believe that the introduction of bitcoin ETF’s in 2021 or 2022 will provide a significant catalyst for the next major surge in bitcoin’s price.

Some investment experts suggest that investor can take exposure to bitcoin by buying MicroStrategy, Coinbase or Riot Blockchain shares - what do you think about such an idea?

I agree. Given the very large amount of bitcoin on MicroStrategy’s balance sheet, it serves as a reasonable proxy to owning bitcoin outright within a brokerage account. Coinbase has the first-mover advantage in the cryptocurrency space and should rise and fall with the popularity of all cryptocurrencies. Riot Blockchain, as a major bitcoin miner, serves as a leveraged way to play the price of bitcoin over time. It tends to perform extremely well during bitcoin bull markets and extremely poorly in bear markets. It’s volatility is not for the faint of heart, especially among traditional blue chip equity investors.

Finally, a request for a forecast: how much longer will the current boom in bitcoin and cryptocurrencies last? What level will the BTC / USD rate reach at the top of this boom? And will the bear market start first on altcoins or bitcoin?

Admittedly, the strength and duration of this pullback from over $60k per bitcoin has surprised even me. But I think we are at or near peak bearish narratives and price action, and that better days are coming soon. Since 2019, I have been predicting a peak bitcoin price of $400,000-500,000 by the end of 2021. I still think it might happen. The current price action is quite similar to the first half of 2013, which finished the tumultuous year with a 10x price increase from October through December. This seems fantastical at the moment, but bitcoin tends to surprise even the most optimistic hodlers.

And if we look at the very long term, what do you think will be the BTC price in USD in 8-10 years?

This is obviously just my opinion, but I think one bitcoin will be worth well over $1 million by 2030.

Jeff Ross - Founder and managing director of Vailshire Capital Management. Dr Ross is a fellowship-trained Interventional Radiologist and currently serves as a board-certified Diagnostic Radiologist (teleradiology). Passionate about investing wisely and teaching others to do the same, Jeff is a former contributor for The Motley Fool and occasional contributor for Seeking Alpha.