“There’s definitely more upside for gold” – says Jan Nieuwenhuijs, Voima Gold analyst

“Much of the money that was pumped into financial assets will seek a safe haven: gold” – according to Jan Nieuwenhuijs, Voima Gold analyst.

Piotr Rosik: Over the last 12 months gold denominated in USD gained 25%. Do you think this is just the beginning of the "bull market"? Why, if so? What are the signs that indicate this?

Jan Nieuwenhuijs (Voima Gold): Yes, I think this was just the beginning of the bull market. After years of “unconventional monetary policy” central banks have created massive asset bubbles, and counterproductive outcomes in the real economy such as decreased productivity through the zombification of companies and banks.

REKLAMA

Currently, world debt to GDP is at record highs, the economy is zombified and the coronacrisis is rapidly accelerating. Financial losses will have to acknowledged, and much of the money that was pumped into financial assets will seek a safe haven: gold.

Gold price (USD)

In 2008 gold depreciated during the bear market in stocks. After the first QE, in 2008, it headed north. Can it still get cheaper during the current bear market? Or maybe the fact that FED has recently launched unlimited QE means that “engine”, increasing the price of gold, is already running?

In the short-term I don’t rule out the gold price can go down. This is because the coronacrisis is deflationary in my view, which can cause investors to stay in bonds or cash. In the short-term it remains to be seen if the Fed is printing enough to stave off deflation. Long-term it will succeed. The Fed needs inflation to lower the debt burden. However, it’s risking losing control because this time around they need to print an order of magnitude more than in recent years.

Additionally, a new banking crisis will unfold. Many companies are currently going bankrupt which will hurt their banks. In Europe, depositors are likely to be “bailed-in” (lose their money). These circumstances will boost demand for gold, especially with interest rates at or below zero. Gold has no counterparty risk, in contrast to cash, bonds, stocks, and derivatives.

If you think about it, a higher gold price is beneficial for central banks, as it spurs inflation and increases the value of the gold on their balance sheets, which will make up for losses on other assets they hold. It was long thought that (Western) central banks are against gold, but that’s not the case anymore. Just look at the Polish central bank. It bought 100 tonnes of gold in 2019 and repatriated it. It could have bought sovereign bonds, but it didn’t. To me it’s clear why: yields on bonds have vanished and the risk of default, outright or through inflation, is increasing.

Some central banks, for instance Russian central bank, have already announced that they are suspending gold purchasing procedures. Is this a serious blow to the demand side on gold?

I don’t think so. There will be new buyers to compensate for less demand from the Russian central bank. The Russian central bank has been smart to buy gold when it was cheap.

Gold reserves of chosen central banks (tonnes)

Source: World Gold Council

Can you please explain what causes the difference in the price of gold on the OTC market and on the COMEX exchange in recent days?

What happened was that three large refineries in Switzerland were closed, and options to transport gold through air got restricted, due to the coronavirus. On the COMEX two dynamics evolved. One, due to the physical supply congestions, it became increasingly attractive to buy futures and stand for delivery. Two, for the shorts it meant it became more difficult to make physical delivery of 100-ounce bars. By exiting their short position, they were bidding up the price on the COMEX.

The spread that was created between the COMEX futures market price and the London spot price can’t be closed by arbitragers, as this would require to “buy spot and sell futures.” In other words, to buy 400-ounce bars in London, recast them somewhere into 100-ounce bars and fly them to New York to sell. The spread is still very large. It’s a reflection of the constraints in the physical gold market.

Can physical gold actually run out? I understand that this would be a factor significantly supporting the increase in bullion price?

In theory not. Because all gold ever mined is still above ground and it’s mainly used for monetary purposes, there can never be a shortage of gold. It can be, though, that the price is too low.

Some economists say, “there is not enough gold in the world to serve as money.” Of course, this is not true. If there is not enough gold, the price goes up. At the right price there’s always enough gold.

However, due to the coronacrisis we see a lot of different gold prices now. Premiums on gold coins in the US are elevated (or they are sold out) relative to London spot. Again, because it’s currently difficult to ship large bars from, for example, London or mines to refineries and Mints to increase coin supply. The high premiums on gold products we currently see, are on one hand due to strong demand, but also due to supply chain issues. Kindly note, in other parts of the world coins are still trading at a premium equal to twelve months ago.

So, we can’t run out of physical gold, but there can be temporary supply constraints, which are extreme now.

US Gold Eagles premium at Apmex +11%

— Jan Nieuwenhuijs (@JanGold_) March 31, 2020

US Silver Eagle premium at Apmex +120%

via https://t.co/xiriyOLT40

Plus some perspective https://t.co/g7PKWGid4e pic.twitter.com/zwtRVwiuW3

Do you observe the gold producers' shares market? Can you say something about the condition of the industry and its prospects? Will the shares of "golden companies" grow in the coming months or quarters?

Not really. I view the gold market from a perspective of economics. As such, annual mine output has little impact on the price of gold in the short and medium term. Gold trading in above ground stocks drives the price in the short and medium term. In the long run mine output does play a role as it can increase or decrease the pace with which the above ground stock swells.

Gold mining companies and valuing their shares are not my specialty.

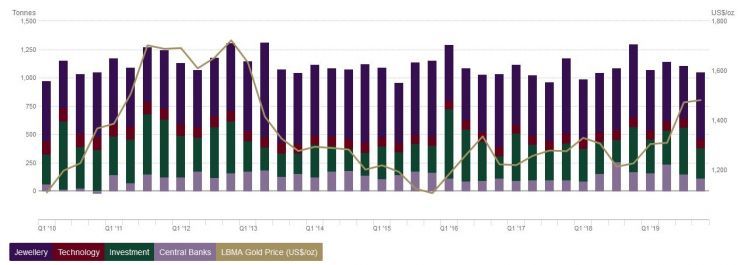

As we all know, almost the whole world is in the lock-down. Gold is used in the jewelry industry. Certainly, the demand for ore from this industry will fall. How much? Will this affect the price of gold?

When the price of gold rises jewelry demand falls. But this is not very important for the gold price. Jewelry buyers are “price sensitive”, meaning they are not driving the price. Jewelry demand provides a floor for the gold market.

The gold price is mainly determined by Western institutional supply and demand. Simplified: institutional demand is the “cause”, jewelry demand is the “effect”.

Gold demand stats

Source: World Gold Council

What are your forecasts for gold in USD in the short, medium and long term? How much will an ounce cost in 3 months, in 12 months, and how much in 3-5 years?

I wouldn’t feel comfortable putting numbers on this. I haven’t made models yet to try and predict the gold price. Maybe I will in the future.

What I have studied in recent years is the mechanics of the global gold market and economics. At the moment, I find gold’s greater purpose—protecting one’s savings and providing financial stability—more important than investing in gold mining stocks. The price of gold can be volatile in the short term, in the long run it preserves one’s purchasing power. Since the euro was created in 1999, it has lost 80% of its value versus gold. These are the trends I focus on.

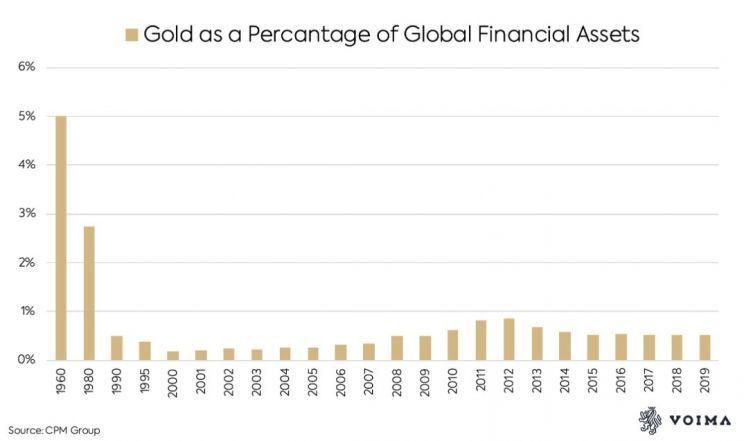

Another reason why I wouldn’t feel comfortable predicting the gold price, is because I believe we have come to the end of the current financial system. We’re heading for a monetary transition. During these times of radical uncertainty, investors might change the way how to approach gold. Instead of assessing if the price is under or over-valued relative to US real interest rates (gold and US real rates have shown a strong correlation in recent years), they will simply decide what percentage of their portfolio to hold in physical gold to survive the reform.

What is the fundamental value of gold in your opinion at the moment? Can it be calculated and how to do it? According to some models, e.g. the Lighthouse model based on Eddy Elfenbein's indications, an ounce is currently worth $ 8,900, not $ 1,600 ...

All value is subjective. I believe that modeling the gold price is more difficult than, for example, stocks, as the gold price is subject to long-term trends and systemic inputs (geo-politics and monetary evolution). However, if we look at gold’s purchasing power in the US over the past 200 years, we see it increasing. This makes sense, because when economies develop and production becomes more efficient the price of goods should fall. Hence, money that is not created by central banks (gold) slowly rises in purchasing power long-term.

Gold / silver ratio is around a record level. What is the reason, in your opinion and how long will this situation last?

One explanation is that silver has lost part of its monetary role. Throughout history silver was more used as a medium of exchange and gold more as a store of value. Gold was too valuable to buy groceries with, so silver was used for payments. The fact silver’s physical properties were inferior to gold, were taken for granted.

Through technological development what we nowadays use as a medium of exchange is electronic and can be a substitute for paper money, but also other assets. Demand for silver as a medium of exchange has fallen. Still, the ultimate store of value is physical gold. Because gold is scarcer and doesn’t corrode, it’s superior to silver as a store of value. Gold is immutable. Many central banks and wealthy people store gold in their vaults.

I believe these developments partly explain why the gold-silver ratio in ancient Sumer was at one point 1 and now it’s 114.

Is it better to accumulate gold in physical form or do you also allow investing in "paper gold" - various types of funds, ETFs or contracts? Can you recommend any “paper” instruments based on physical gold?

If you are not a speculator, you should only buy physical gold. Only the physical metal doesn’t have counterparty risk and is fully independent of the financial system—which it offers insurance against. With ETFs you have numerous counterparties in the operational chain, including banks. What if banks start failing in a few weeks, are you 100% sure your investment in their ETF is safe. I don’t think so.

When it comes to investing in physical gold, do you think an investor should buy bars, bullion coins like Krugerrands or collectors coins? Or maybe a little bit of everything?

A bit of everything. The benefit of storing the majority of your gold at a trusted dealer with vaulting services (outside the banking system), is that you can easily buy and sell gold in whatever weight (per gram). Storing bars and coins at home can be inconvenient when you want to buy or sell smaller portions than the weight you keep your products in.

Having said that, one can also consider to hold a few gold and silver coins (in a nearby safe). For the unlikely event that there is a power out. Gold is about insurance.

What portion of the investment portfolio should currently be located in gold? I know that Swiss investment banks have always recommended that it should constitute from 10% to 30% of the portfolio - should it be more in the current situation?

Diversification is always important because no one knows the future. Most studies I have come across concluded an allocation of around 15% was best in the long run. But in times of extreme financial uncertainty the allocation can be increased. In 2019 gold accounted for 0.52% of global financial assets, according to data by CPM Group. To me that’s low, given the dire state the world economy is in. There’s definitely more upside for gold.